The Surprising Rise of Ties as an Investment Asset

Ties are traditionally seen as a safe investment asset, but recent years have shown that they have become an increasingly popular choice for investors looking for higher returns. The surprising rise of ties can be attributed to several factors, including their stability and long-term growth potential. Many countries with strong financial systems, such as Switzerland and Singapore, have also recognized the value of ties as an investment asset. Additionally, the low correlation between bonds and other asset classes has made them a good diversification strategy for portfolios. Despite some challenges faced by ties, such as political and economic uncertainties, the popularity of ties is expected to continue to grow in the coming years. Overall, ties provide a unique investment opportunity that can offer both stability and high potential returns, making them a valuable addition to any investor's portfolio.

In recent years, ties have emerged as a fascinating and unexpected asset class, with some high-end neckties reportedly appreciating in value at a faster rate than other collectibles such as stamps, coins, and even luxury watches. This article explores the phenomenon of tie appreciation, the factors that contribute to it, and the potential risks and rewards associated with this unconventional investment.

The Rise of Tie Appreciation

At first glance, the idea that ties could be considered a valuable asset may seem absurd. After all, what is a piece of fabric tied around one's neck? However, upon closer inspection, it becomes clear that there is indeed a market for high-quality ties, and that they can appreciate in value over time.

One of the key factors driving tie appreciation is rarity. High-end designer ties are often produced in limited quantities, making them scarcer and more sought-after by collectors. For example, some iconic ties, such as those from iconic fashion houses like Dior and Versace, have been in production for decades and are now highly valued due to their historical significance and cultural impact. Additionally, unique patterns, colors, and materials further enhance the appeal of these ties, making them even more desirable to collectors.

Another factor contributing to tie appreciation is their association with status and prestige. In the past, ties were typically worn by men in formal settings, such as business meetings or weddings. As a result, wearing a particular tie was viewed as a sign of one's social standing and expertise. Today, however, ties have evolved beyond their traditional function as a form of dress code and are now seen as a fashion accessory that can add style and sophistication to any outfit. This shift in perception has made ties increasingly attractive to collectors who view them as investments in both fashion and culture.

The Risks and Rewards of Tie Investing

While the potential upside of tie investing may seem appealing, there are also significant risks to consider. For starters, the value of ties can be highly volatile, with prices fluctuating significantly from year to year depending on various factors such as fashion trends, economic conditions, and celebrity endorsements. This makes it difficult for investors to predict future price movements and increases the likelihood of losses if they sell at the wrong time.

Furthermore, ties are not backed by any tangible assets or financial statements, which means that their value is largely based on subjective factors such as rarity and desirability. This makes it challenging for regulators to monitor and enforce any regulations governing tie investing, which can increase the risk of fraud and scams.

Despite these risks, some experts believe that the benefits of tie investing outweigh the drawbacks. For instance, unlike other collectibles such as art or rare books, ties are relatively easy to obtain and store without incurring significant storage or maintenance costs. They are also highly versatile and can be worn in a variety of settings, making them a more practical investment than some other collectibles.

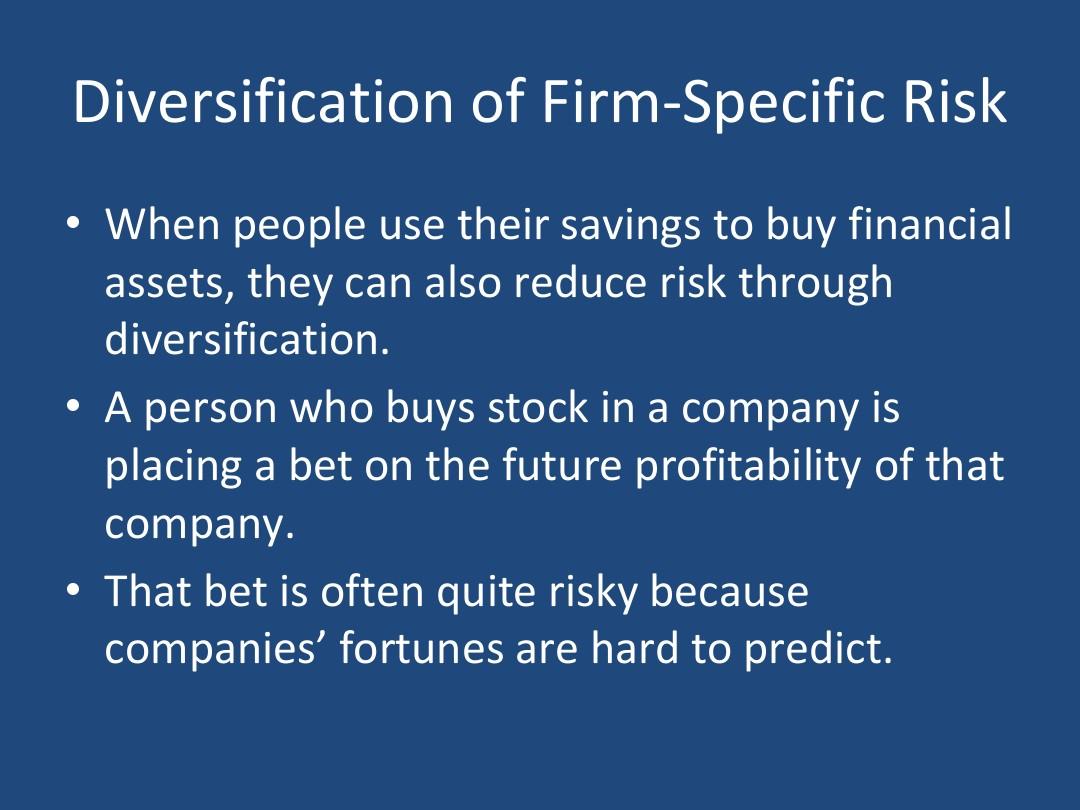

In addition, some experts argue that tie investing could serve as a hedge against inflation and other economic uncertainties. By diversifying one's investment portfolio with a small allocation of high-quality ties, investors can potentially protect their wealth from the volatility of the stock market and other financial instruments.

Conclusion

In conclusion, the rise of ties as an investment asset represents a fascinating development in finance that challenges traditional notions of what constitutes a valuable asset class. While there are certainly risks associated with tie investing, there are also potential rewards for those willing to take the leap. As with any investment decision, it is important for individuals to carefully consider their goals, preferences, and financial circumstances before deciding whether or not to invest in ties.

Articles related to the knowledge points of this article::

Title: Creating a Stylish and Professional Look with White Suits: A Guide to Pairing Neckties

Title: The Perfect Blend: Combining a Navy Blue and Green Suit with the Perfect Tie

Title: The Art of Wearing a Suit: An Ode to the Common Mans Formal Attire

Dress to Impress: The Art of Wearing a Tie and Shirt

Title: Mastering the Art of Tie Knots: A Guide to Boys School Outfit